Why It Matters More Than Ever:

Bitcoin has transitioned from being a niche financial instrument to a widely recognized digital asset, sparking a transformative wave across Wall Street. With a market price exceeding $100,000 at the time of writing, Bitcoin's potential trajectory to $13 million per coin, as predicted by proponents like Michael Saylor, raises profound implications for institutional adoption, corporate strategies, and the global economic landscape. This blog examines the factors driving Bitcoin’s rise, its integration into traditional finance, and the broader implications for wealth preservation, economic stability, and global monetary systems.

https://youtu.be/AhAia950nbo?si=aVJwmZVe_W81XUVo

PREDICTIONS AND MODELS:

The Trajectory to $13 Million:

Michael Saylor’s long-term forecast of Bitcoin reaching $13 million per coin relies on the Bitcoin 24 model—an open-source macroeconomic tool available on GitHub. This model suggests that Bitcoin adoption grows at an annual average rate of 29% over 21 years, reflecting a deceleration from its current growth rate of 60% per year. Central to this projection are the following:

• Institutional Endorsements: BlackRock’s inclusion of Bitcoin in its portfolio allocation models legitimizes the asset class for conservative investors. The company’s backing of Bitcoin ETFs, such as IBIT, marks a historical shift, with these ETFs becoming some of the most successful in financial history.

• High-Net-Worth Individual Participation: Wealthy individuals who once viewed Bitcoin as risky now see it as an institutional-grade asset, driven by endorsements from major financial entities and robust market performance.

• Corporate and Government Adoption: Companies like MicroStrategy, Riot, and Japanese firms such as Meta Planet are recapitalizing their balance sheets using Bitcoin. Additionally, discussions about national Bitcoin reserves—such as the U.S. considering a strategic Bitcoin reserve—add to its credibility as a global asset.

INSTITUTIONAL ADOPTION:

A Paradigm Shift Institutional Adoption the Turning Point for Bitcoin:

The entry of institutional players, including pension funds, university endowments, and insurance companies, marks a pivotal moment in Bitcoin’s journey. BlackRock’s guidance to allocate 2% of portfolios to Bitcoin signals a shift in traditional financial strategies. As ETFs like IBIT achieve record success, Bitcoin is increasingly viewed as a legitimate asset class. Additionally, corporate pioneers such as MicroStrategy amplify Bitcoin’s integration into Wall Street by:

• Issuing Convertible Bonds: MicroStrategy has issued significant convertible bonds and equity-backed securities tied to Bitcoin. These instruments have attracted both equity investors and derivative traders, increasing liquidity and market efficiency.

• Strengthening Market Performance: By leveraging Bitcoin to recapitalize its balance sheet, MicroStrategy has consistently outperformed traditional indices like the S&P 500.

• Enhancing Liquidity and Accessibility: Bitcoin’s inclusion in institutional portfolios and financial instruments provides an accessible entry point for traditional investors, thereby fostering broader market participation.

https://www.visualcapitalist.com/sp/top-10-largest-corporate-holders-of-bitcoin

RETHINKING MONEY:

Bitcoin as Digital Capital:

Bitcoin represents the evolution of money into two distinct components:

1. Currency: The medium of exchange, represented by fiat currencies like the dollar. These currencies are prone to inflation and government manipulation.

2. Capital: The store of value, historically dominated by gold, equities, and real estate. These assets have varying degrees of liquidity, fungibility, and security.

Saylor positions Bitcoin as the ultimate digital capital, offering a store of value free from inflationary pressures and governmental manipulation. Unlike traditional assets, Bitcoin is both liquid and fungible, making it ideal for long-term wealth preservation. For instance, an investor can securely store Bitcoin in cold storage for decades, confident in its resistance to depreciation.

Bitcoin also bridges a critical gap for individuals and institutions in economically unstable regions. In countries experiencing hyperinflation, such as Venezuela, Argentina, and Turkey, Bitcoin provides a reliable alternative for wealth preservation. Its decentralized nature ensures accessibility and security even under oppressive regimes.

EDUCATION AND ADOPTION

Overcoming Scepticism:

Despite its rising prominence, Bitcoin adoption faces hurdles stemming from a lack of understanding. According to Saylor, educating the remaining 95% of the world about Bitcoin’s advantages is crucial. Key aspects include:

• Inflation Protection: Fiat currencies lose buying power due to inflation, as governments print money at rates of 7% or higher annually. For example, beachfront properties in prime locations have appreciated at a consistent annual rate of 7% over the past century, reflecting the devaluation of fiat currency.

• Global Accessibility: Bitcoin’s borderless nature allows individuals to bypass traditional financial systems. In regions with failing banks or restrictive capital controls, Bitcoin offers a lifeline for financial independence.

• Volatility as a Feature: While often cited as a drawback, Bitcoin’s volatility is a function of its emerging market dynamics and the open capital markets it operates within. This volatility creates opportunities for high returns, attracting both retail and institutional investors.

Strategic Recommendations for Governments and Corporations:

To ensure leadership in the digital monetary era, governments and corporations should:

1. Embrace Stablecoin Regulation: Establish a framework for dollar-backed stablecoins to solidify the U.S. dollar’s dominance as a reserve currency. Stablecoins like USDT and USDC, when backed by U.S. treasuries, can expand global demand for dollar-denominated assets.

2. Support Bitcoin Reserves: Develop national reserves that incorporate Bitcoin, ensuring economic resilience and hedging against fiat devaluation.

3. Facilitate Corporate Participation: Enable companies to issue securities backed by Bitcoin, fostering broader adoption and integrating digital assets into traditional finance.

4. Promote Public Education: Launch initiatives to educate the public about Bitcoin’s benefits, addressing misconceptions about its volatility, energy usage, and security.

Bitcoin’s Role in Economic Stability:

As governments explore integrating Bitcoin into national reserves, the asset’s potential to stabilize economies becomes evident. By holding Bitcoin, nations can:

• Hedge against inflation and currency devaluation.

• Diversify reserves with a non-correlated asset.

• Encourage foreign investment by signalling a forward-thinking economic strategy.

Corporations adopting Bitcoin also benefit from increased financial agility. For example, firms like Riot and Marathon Digital leverage Bitcoin to secure convertible bonds, raise capital efficiently, and enhance shareholder value. Additionally, Bitcoin mining operations play a crucial role in optimizing energy usage. By utilizing stranded or excess energy sources, mining operations transform potential waste into productive economic activity, further strengthening the network’s sustainability and resilience.

Bitcoin and the Future of Global Trade:

The integration of Bitcoin into global trade networks has the potential to revolutionize cross-border transactions. Traditional systems involve high fees, lengthy settlement times, and reliance on intermediaries. Bitcoin’s decentralized nature allows for near-instant transactions, significantly reducing costs and improving efficiency. Moreover, Bitcoin’s programmability through smart contracts could streamline complex trade agreements, reducing disputes and ensuring compliance.

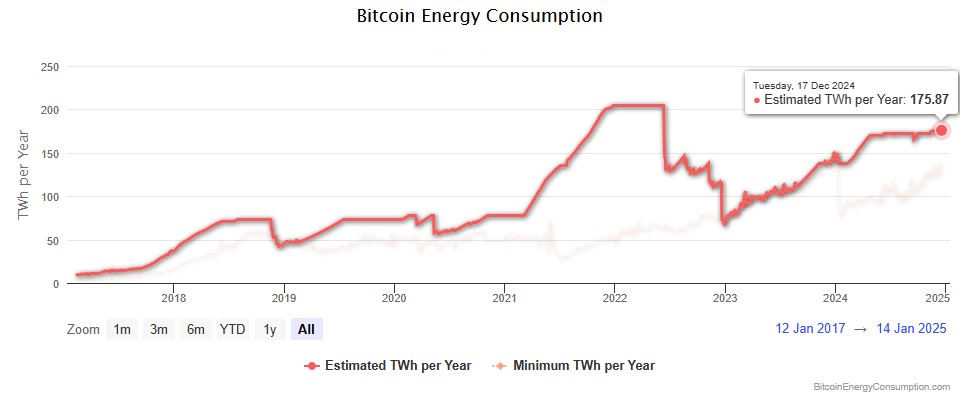

Addressing Environmental Concerns

Bitcoin’s energy consumption has been a contentious issue, with critics highlighting its potential environmental impact. However, the narrative is shifting as miners increasingly adopt renewable energy sources and innovative technologies to reduce their carbon footprint. For example, mining operations in Iceland and Canada leverage geothermal and hydropower resources. Additionally, Bitcoin’s energy-intensive proof-of-work system incentivizes investments in green energy infrastructure, which can benefit broader energy networks.

https://digiconomist.net/bitcoin-energy-consumption

Global Electricity Caparison Costs and Bitcoin Mining Trends

This section evaluates the cost of 175 terawatt-hours (TWh) of electricity across three major economies and highlights global Bitcoin mining trends.

Electricity Costs for 175 TWh (in GBP):

• United Kingdom: £63 billion (£0.36/kWh)

• United States: £25.2 billion (£0.144/kWh)

• China: £10.92 billion (£0.0624/kWh)

The stark variation in costs reflects differences in energy pricing and consumption structures. China remains the most cost-effective for electricity among the three nations.

Global Bitcoin Mining Trends:

• United States is the global leader, accounting for ~37% of Bitcoin's hash rate, driven by affordable energy and supportive policies in states like Texas and Georgia.

• Kazakhstan follows, contributing ~15% due to low energy costs but faces regulatory challenges.

• Russia ranks third (~10%), leveraging cheap electricity and cold climates but facing geopolitical risks.

• China contributes ~6% despite a ban on mining, with covert operations continuing in remote areas.

The United States’ dominance highlights its favourable infrastructure and energy environment for high-power activities like Bitcoin mining, while energy pricing differences underline competitive economic advantages globally.

Conclusion

Bitcoin’s rise signifies a paradigm shift in how capital is stored, transferred, and perceived. As institutional adoption accelerates, driven by its appeal as a digital store of value, Bitcoin stands poised to redefine global finance. The integration of Bitcoin into Wall Street represents not just an evolution of financial markets but a fundamental rethinking of wealth in the digital age. To capitalize on this transformation, education, regulation, and innovation must guide the path forward. By embracing Bitcoin, individuals, corporations, and governments alike can ensure economic stability and growth in an increasingly digital world.